When you’re a freelancer earning from overseas platforms (e.g., Upwork, Fiverr, Payoneer etc.), your banking choice should reflect your workflow and cross-border needs. Here are the key factors:

- Receiving overseas payments / foreign currency retention

- Can the account easily receive foreign remittances (USD/GBP/EUR)?

- Does the bank allow you to retain a portion of earnings in foreign currency (via an Exporter’s Special Foreign Currency Account — ESFCA) rather than forcing immediate conversion to PKR?

- Example: Meezan Bank allows freelancers to open checking in PKR and also open a foreign currency retention account in USD/GBP/EUR. Meezan Bank+2Meezan Bank+2

- Example: Standard Chartered Bank Pakistan offers a “Freelancer Digital/Exporter Special Foreign Currency Account” in multiple currencies. Standard Chartered+2Standard Chartered+2

- This matters because if you convert immediately at a weak rate, you lose value; retention in FCY gives flexibility.

- Minimum balance, account maintenance fees & other charges

- Many freelancer-friendly accounts waive minimum balance or maintenance fees. Example: Standard Chartered’s “Bank at Zero” minimum balance for the Freelancer Digital account. Standard Chartered+1

- Free/low cost for inward remittance, debit card issuance, online banking are positives.

- Ease of documentation / onboarding

- Freelancers often lack traditional salary slips or business registration. Banks that accept freelance client invoices, online payment screenshots or service-contract emails make it easier.

- Example: Meezan’s FAQ shows that freelancers need an undertaking + valid ID; the “proof/source of income” requirement is tailored for freelancers. Meezan Bank+1

- Exchange rate and currency conversion policies

- If you receive in USD/GBP/EUR, what rate will the bank apply when converting to PKR? Are there hidden conversion fees?

- Can you withdraw or spend in foreign currency? For example, some banks let you open a foreign currency account and spend from it (e.g., digital subscriptions abroad).

- Global debit card / overseas usability

- If you work with international clients or purchase software/subscriptions abroad, having a debit card that works globally (or a linked foreign currency account) is beneficial.

- Also consider withdrawal/ATM fees (especially when abroad) and foreign usage charges.

- Digital/online banking features

- Since freelancers often operate remotely, strong mobile/internet banking, quick remittance credit, branchless services are useful.

- Also check whether you can open the account without physical branch visit (or minimal visit).

- Tax and regulatory compliance

- Receiving foreign income means you must comply with Pakistan’s regulations (e.g., withholding tax on export of services, registration with Pakistan Software Export Board (PSEB) if applicable, NTN registration etc.). Some banks provide tax facilitation services. Example: Meezan has “Tax Facilitation Services” for freelancers. Meezan Bank

- Make sure the bank has clear guidelines for freelancer remittances to avoid unexpected holds or compliance check delays.

- Reputation & service reliability

- Look at user reviews from fellow freelancers (online forums, Reddit etc.). For example, one Reddit user said: “I’ve been using Standard Chartered … but their exchange rates are pretty low, and it’s cutting into my earnings.” Reddit

- So while the bank may have the “freelancer account”, its actual FX/conversion and service must also be good.

Top Banks for Freelancers in Pakistan

Here are some of the strong options currently available for freelancers. I’ll outline the key features, pros & cons.

1. Standard Chartered Bank (Pakistan)

6

Why it’s good for freelancers

- They have a dedicated “Freelancer Digital / Exporter Special Foreign Currency Account (ESFCA)” product: “Greater convenience for your freelancing payments… available in PKR, USD, GBP and EUR for greater flexibility.” Standard Chartered+1

- No minimum balance (“Bank at Zero”) for the Freelancer account. Standard Chartered+1

- Digital onboarding process (apply online) for the Freelancer account. Standard Chartered+1

- Free inward remittance (as per launch news) and complimentary international debit card for freelancers. The Business Standard

Some considerations - As per user feedback, the exchange rates might not always be the most favourable, so you want to compare when converting from foreign currency. Reddit

- Although the digital onboarding is advertised, some documentation or branch-visit may still be required depending on your case — always confirm at your local branch.

Summary: A strong choice for freelancers dealing in foreign-currency income, especially if you value flexibility and a global bank brand.

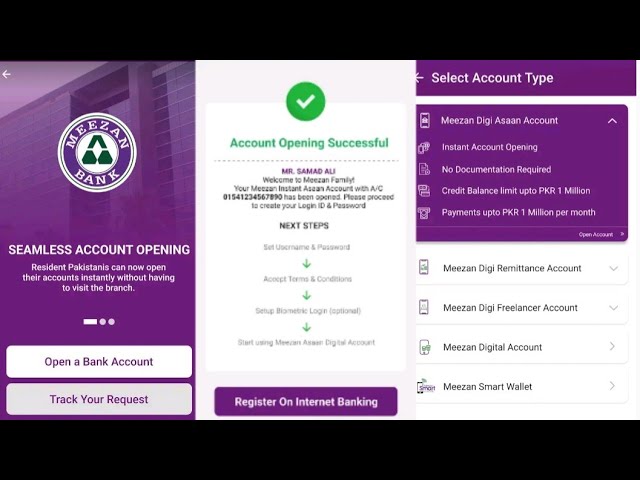

2. Meezan Bank

5

Why it’s good for freelancers

- They have a “Digital Freelancer Account” product for freelancers in PKR (current & savings) with digital onboarding. Meezan Bank

- The FAQ (“Freelancers-FAQ”) shows that freelancers engaged in online/digital services receiving overseas payments are eligible. Meezan Bank

- They also allow an ESFCA foreign-currency retention account in USD/GBP/EUR. Meezan Bank

- Being a leading Islamic bank, if you prefer Shariah-compliant banking, this is a plus.

Considerations - The foreign-currency retention and conversions still follow SBP regulations, and you may need to provide proof of service, invoices/agreements, etc. (as per their document list). Meezan Bank

- If you regularly receive large foreign payments, you might want to check their FX conversion spreads and how quickly remittances are credited.

Summary: Very good for freelancers who receive overseas payments and prefer Islamic banking; solid features with digital options.

3. Bank Alfalah

4

Why it’s good for freelancers

- They offer a “Freelancer Digital Current Account” and “Freelancer Digital Savings Account” targeted at freelancers. Features include PKR + USD ESFCA, retain up to USD 5,000/month or 50% (whichever higher) in FCY. Bank Alfalah+2Bank Alfalah+2

- No minimum balance requirement for the Freelancer account. Bank Alfalah

- Instant digital account opening via their RAPID portal (no branch visit) is advertised. Bank Alfalah

Considerations - Some freelancers report that although the service promises reduced withholding tax (0.25%) for PSEB-registered freelancers, the bank may still apply 1% until you challenge it. Example: one Reddit poster: “I submitted my PSEB certificate … but they’re still deducting 1%.” Reddit

- Always verify the schedule of charges and FX spreads.

Summary: A very good option especially for freelancers wanting dual‐currency (PKR + USD) and digital onboarding; just ensure you follow up on documentation for correct tax/withholding benefits.

4. Faysal Bank

6

Why it’s good for freelancers

- They advertise an “I.T Exporter & Freelancer Account” (Shariah-compliant) with a primary PKR account and an associated ESFCA (USD/GBP/EUR), allowing retention of up to USD 5,000/month or 50% of proceeds. faysalbank.com

- They offer full digital account opening via their “Burraq Digital Account” portal. faysalbank.com+1

Considerations - Make sure you review the detailed schedule of charges and whether you must maintain certain average balance to access “free” services. For example, they mention “on maintaining of Rs. 50,000/- monthly average balance” for some freebies. faysalbank.com

- As always, check the FX conversion and time for remittances to credit.

Summary: A solid and very freelancer-targeted product, especially for those preferring Islamic banking and digital onboarding.

5. United Bank Limited / MCB Bank Limited / Habib Bank Limited

- While these banks are large, established and reliable, they may not always have a dedicated “freelancer” labelled account with dual-currency/ESFCA features publicly highlighted (or the onboarding may be more “general current/savings account” rather than freelancer-specialised).

- Example: UBL offers a “Freelancer Account” page: “Retain USD 5,000 per month … choice of USD/GBP/EUR” under their UBL Freelancer Account. ubldigital.com

- Hence, they can be used, but you’ll want to check the specific freelancer-friendly features (digital onboarding, FCY retention, minimal fees) vs. general accounts.

Summary: Good fallback options, especially if you already bank there, but you may have to ensure the features you require are available.

Comparison of Transaction Fees and Exchange Rates

Here are some of the cost/fee considerations you should compare among these banks. Note: exact rates vary by bank, date, and individual profile; always check the bank’s current “Schedule of Charges” and the inter-bank/retail FX rate on the day.

| Fee / Component | What to check | Example insights |

|---|---|---|

| Inward foreign remittance fee | Does the bank charge to credit your account when you receive payment from abroad? | Standard Chartered’s freelancer account launched with “free inward remittance” per news. The Business Standard+1 |

| Minimum balance / maintenance fee | Are there penalties for falling below a balance? Are there monthly/annual maintenance fees? | Standard Chartered says “Bank at Zero” minimum balance for Freelancer account. Standard Chartered+1 |

| Currency conversion spread / rate | If you receive USD/GBP and convert to PKR, what rate do you get? Are there additional charges? | One user said Standard Chartered’s conversion rate wasn’t favourable. Reddit |

| Foreign currency retention account / spending | Can you retain foreign currency rather than convert immediately? Can you spend from it (e.g., pay subscriptions, withdraw overseas)? | Meezan’s FAQ shows allowance for ESFCA account in USD/GBP/EUR. Meezan Bank+1 |

| Withdrawal/ATM/overseas usage fees | If you withdraw cash abroad or pay online overseas, what fees apply? | General banking charges show for international ATM withdrawals some banks charge 2-4% etc. Wikipedia |

| Withholding tax on export of services | Income from freelancing (export of services) may be subject to withholding tax. Ensure bank applies correct rate. | Bank Alfalah advertises retention up to USD 5,000/month; some Reddit users said they were incorrectly charged 1% instead of 0.25% for PSEB-registered freelancers. Reddit+1 |

Tip: When receiving payments from platforms like Upwork/Fiverr, check what currency the platform remits in, whether the remitting bank charges a fee, whether your Pakistani bank charges to receive it, and what FX rate you’ll get when converting. Even a small difference in rate or hidden fee can impact your earnings significantly over time.

Step-by-Step Guide to Opening a Freelancer-Friendly Account

Here’s a general process you can follow, with variations for each bank.

- Decide on the bank and account type

- Pick the bank offering best features for you (e.g., ESFCA, dual currency, minimal fees).

- For example: Standard Chartered, Meezan, Bank Alfalah, Faysal Bank.

- Gather required documents

- Valid CNIC/NICOP/SNIC (Pakistani national ID).

- Proof of residence (utility bill, address).

- For freelancers: “Proof of source of income” — this might be email/contract correspondence with clients, client invoices, statement of earnings over last 3 months. Example: Meezan’s document list for freelancers includes “Copy of agreement(s) or email/letter-based correspondence with the clients … Certificate/Statement of earnings for past 3 months”. Meezan Bank+1

- Tax registration (NTN) if applicable; proof of PSEB registration if you want reduced tax rate.

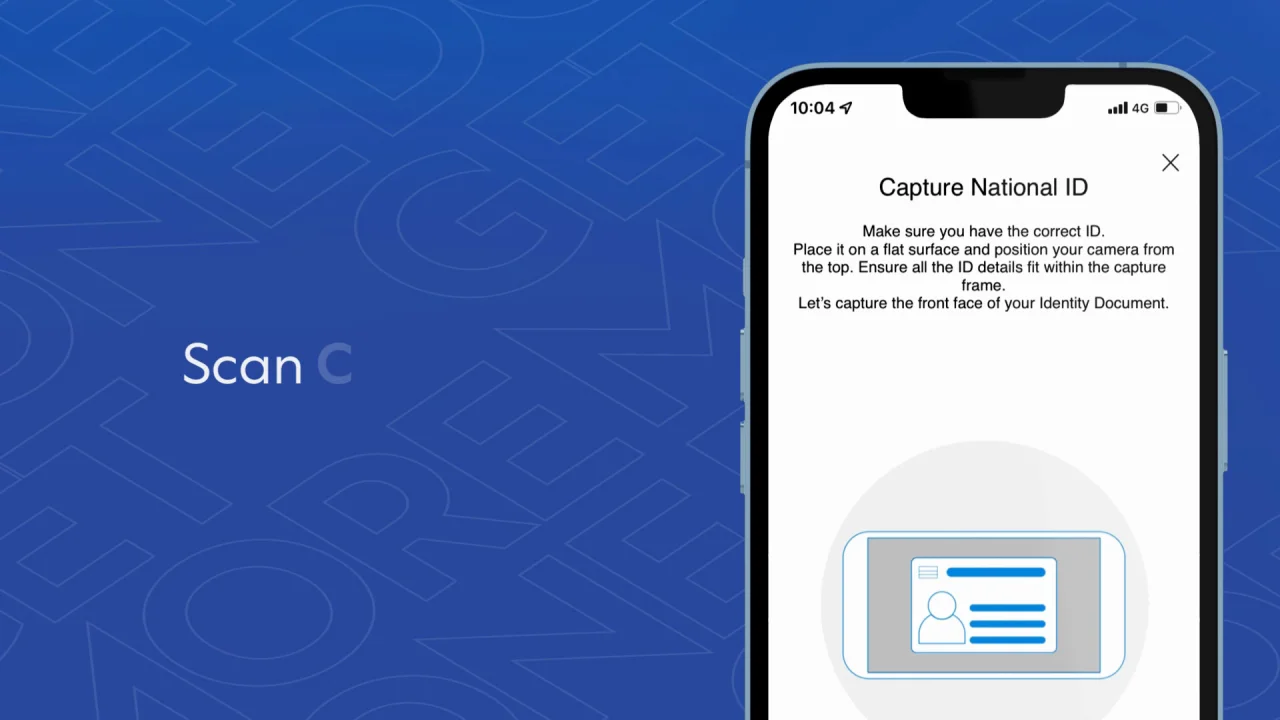

- Open the account

- Many banks allow digital onboarding (e.g., Bank Alfalah advertises instant digital account opening via RAPID portal). Bank Alfalah

- Visit branch if required (some banks may still require branch verification).

- Select the correct product (freelancer account / digital freelancer account).

- Set up foreign-currency retention (if required)

- If you wish to retain part of your earnings in USD/GBP/EUR rather than convert immediately, request the bank to open an ESFCA/FCY account linked to your main account.

- Confirm the retention limits (e.g., up to USD 5,000/month or 50% of export proceeds whichever is higher) – as per multiple banks. faysalbank.com+1

- Provide details of overseas payment channels

- Provide relevant details or purpose codes for incoming payments (the bank may ask to know what kind of services you provide, the platform, client details).

- Ensure you update your earnings platform (Upwork/Fiverr/Payoneer) with the bank account details exactly as given by the bank (name format, IBAN/SWIFT, etc.).

- Link your freelance payment platform

- Add the bank account to your freelancing platform (Upwork, Fiverr, Payoneer) for payments.

- Watch for the first payment to ensure it lands correctly and check what the conversion/credit timeline is.

- Monitor for conversion/retention and fees

- Once you receive payments, check the rate you get for conversion, and whether you want to retain in FCY or convert.

- Keep records of all payments, invoices and contracts — this helps in case of compliance queries or tax audits.

- Maintain compliance and documentation

- File your tax returns (if required) and maintain proof of your freelance services.

- If eligible for reduced tax rate (via PSEB registration etc.), make sure bank has correct purpose code and documentation.

- Keep abreast of SBP regulations for export of services / freelancing.

FAQ Section

Q1: Which bank works best with Payoneer?

There isn’t a one “best bank” universally; much depends on how your Payoneer account pays into Pakistan (currency, method) and how the local bank handles incoming foreign remittances. Some things to check:

- Whether the bank accepts the Payoneer remittance without delay or extra hold.

- Whether the bank allows receiving USD/GBP/EUR from Payoneer and whether you can retain it in FCY.

- Your chosen bank’s FX conversion spread when crediting PKR (if relevant).

From discussions among freelancers, banks like Meezan and Standard Chartered are noted for smoother transfer of freelancing payments in Pakistan. Tenco Consulting+2Meezan Bank+2

Recommendation: Choose a bank with a freelancer or IT-expporter account (as outlined above) and confirm with their branch that they’ve handled Payoneer payments previously — ask for user experience.

Q2: Can I receive Fiverr or Upwork payments through Pakistani banks?

Yes — Pakistani freelancers can receive payments from Fiverr/Upwork into a Pakistani bank account, provided you have an account set up to accept currency via SWIFT/inward remittance. Key points:

- Ensure your bank account details (IBAN/SWIFT) are correctly given to Fiverr/Upwork/Payoneer.

- Some banks require you to register the account as freelancer/IT exporter type (under export of services) so that funds are treated appropriately (ex: ESFCA retention account).

- Check the fees and conversion conditions (your earnings will be converted/credited in PKR or retained in FCY as per your setup).

- One caveat: If the bank treats the payment as local transfer or requires conversion at high spread, your net earnings may reduce. Example: Some freelancers highlighted that although account opened, the FX conversion was “pretty low”. Reddit

Bottom line: Yes you can, but choose the bank and account type carefully and align with your payment platform channels.

Q3: Do banks require proof of income for account opening?

Yes — for freelancer-friendly accounts in Pakistan many banks require proof of income/source of services. Because receiving payments from abroad qualifies as “export of services”, banks must adhere to KYC/AML/foreign currency disclosure regulations. Examples:

- Meezan’s account opening documents require: “Copy of agreement(s) or email/letter-based correspondence with clients … Certificate/Statement of earnings for past 3 months …”. Meezan Bank+1

- Faysal Bank’s FAQ for the Freelancer account states: documents required include “Original CNIC … Utility Bill … Certificate/Statement of earnings for last 3 months OR Agreement(s) or email/letter-based correspondence with the clients …”. digionboard.faysalbank.com

- Bank Alfalah offers online opening for freelancer accounts but also notes “proof of income (related to provision of digital/online services)” required. Bank Alfalah

What this means for you:

You’ll likely need to prepare: - Copy of your CNIC and bio data.

- Some document showing you offer digital/online services to clients abroad (email, platform profile, invoice, payment screenshot).

- Address proof (utility bill, etc.).

- Possibly your tax registration (NTN) or freelancer export registration (if applicable).

So yes — “proof of income” or “proof of source of services” is typically required (though the level of documentation may vary). It’s less heavy than a full business registration, but not zero.

No Responses